- Blog

-

For DTC

Amazon statistics: Trends and insights for 2025

Amazon’s top sellers aren’t guessing. They’re watching the numbers. Here’s the 2025 data to pay attention to.

The numbers behind Amazon selling tell a fascinating story. While millions of people browse the marketplace daily, only a fraction of sellers consistently turn those shoppers into buyers.

Amazon’s ecosystem generates mountains of data every second, from marketplace share and revenue figures to consumer behavior patterns that shift with each season. These statistics aren’t just interesting trivia. They’re the key indicators that successful sellers use to make smarter decisions.

So, we’ve crunched the latest Amazon data to bring you the statistics that actually matter in 2025. Let’s dig in to see what’s shaping Amazon’s marketplace this year.

Amazon sales, revenue, and growth

Let’s start our list of statistics with those that provide insights into Amazon’s sales, revenue, and growth. These give you a glimpse of what the platform can do for your business and how you can harness its full potential.

Amazon continues to dominate the ecommerce market.

Amazon commands nearly two-fifths of the U.S. online shopping market, far outpacing competitors who struggle with just one to six percent shares. In 2024, Amazon generated approximately $144 billion in retail e-commerce sales in the United States, while Walmart lagged behind at $79 million. Despite new challenges from foreign entrants like Temu and Shein, Amazon remains the undisputed leader in the American ecommerce landscape.

Amazon net sales grew 11% year-on-year in Q2 2023.

Amazon generated net sales of $167.7 billion in the second quarter of 2025, compared with $148.0 billion in Q2 of 2024—an increase of 13%. The growth spans all segments with North America up 11%, International up 16%, and AWS climbing 17.5% year-over-year. Amazon’s operating income also jumped to $19.2 billion, while net income reached $18.2 billion, reinforcing the platform’s continued expansion and market strength.

Prime Day 2025 was an unparalleled success.

Amazon declared Prime Day 2025 its biggest event ever, with customers saving billions across more than 35 product categories. The four-day shopping extravaganza broke records for both sales volume and items sold, with standout performers including Dyson, medicube, and Philips Sonicare.

Independent sellers achieved record-breaking sales, with small business owner Anne Maza of Olivia Garden noting it was their “most successful Amazon shopping event since launching in 2019.” Top-selling items included Apple AirPods Pro 2, BIODANCE masks, and Amazon’s own Ring Battery Doorbell and Fire TV Stick HD.

There are almost 200 million Amazon Prime members in the United States alone.

Approximately 75% of Amazon shoppers in the United States now have Prime memberships, bringing the 2024 subscriber count to an estimated 180 million. Despite rising membership costs, Prime’s unmatched combination of free shipping options, exclusive Prime Day discounts, and personalized deals continues to attract consumers.

Consumer behavior and search trends

Shoppers leave digital footprints that tell us exactly what works on Amazon. This section unpacks the latest consumer patterns, from where they begin their product searches to which platforms drive the most traffic. These fresh insights reveal the shopping habits that directly impact your ability to get found and make sales.

Amazon remains the most visited ecommerce platform in the United States.

In March 2024, Amazon.com attracted approximately 2.2 billion combined web visits, climbing from 2.1 billion visits in February. This massive traffic coincided with Amazon’s impressive fourth quarter 2024 net income of approximately $20 billion. The platform’s consistent position as the top-visited marketplace creates unmatched visibility opportunities for sellers looking to maximize their reach.

Approximately 58.1% of social media traffic to Amazon comes from YouTube.

YouTube, Facebook, X (Formerly Twitter), Reddit, and WhatsApp are the top social media traffic referrers to Amazon. However, YouTube leads by a huge margin with almost 6 out of 10 social media visitors coming from the video-sharing platform. Consider partnering with YouTube content creators and influencers to enhance your visibility on the platform.

Consumer shopping habits are evolving with technology and economic pressures.

Today’s shoppers are becoming increasingly AI-friendly, with 56% now comfortable using AI-integrated tools to make purchase decisions. The purchasing landscape continues to shift as one in three consumers reported spending less in 2024 due to inflation concerns.

Meanwhile, both short and long-form content compete for buyer attention across platforms, with trustworthiness emerging as the critical factor in influencer marketing—particularly for Gen Z, where nearly half make purchases based directly on influencer recommendations.

Beauty and Personal Care is one of the top product categories on Amazon.

Product categories like Beauty & Personal Care, Automotive, Clothing, Kitchen & Dining, Appliances, and Electronics consistently perform well on Amazon. Consider these when selecting products to sell on the platform.

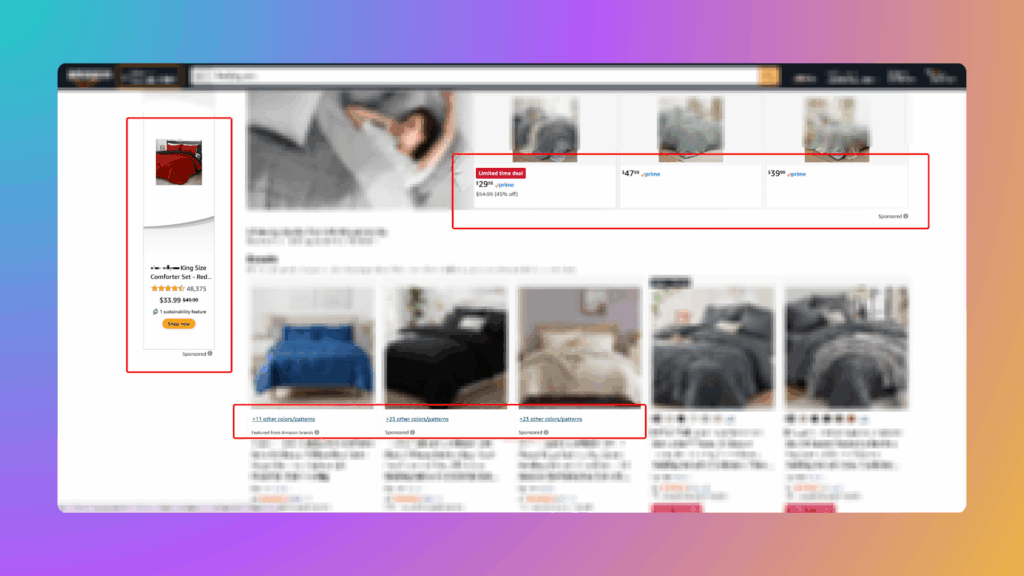

‘Find Deals’ is the most used CTA in Amazon ads descriptions.

In an analysis of 10,000 online ads in the United States in 2022, nearly 3,900 ads used ‘Find Deals’ as their call to action. The second most effective CTA that leads potential buyers to Amazon is ‘Free Shipping’. If you run Amazon ads or other paid ads, consider using these two CTAs.

When purchasing online, more buyers use mobile devices than desktops.

The shift towards mobile shopping is expected to continue. In fact, 60% of online shoppers are on mobile devices when making their purchases. This is significantly higher than the 32% who use their desktop computers. Ensure your listings are mobile-friendly, as more customers make purchases via smartphones and desktops.

Amazon Seller Community

The Amazon Seller Community is a thriving ecosystem of entrepreneurs and small businesses, driven by Amazon’s commitment to empowering sellers. Understanding the dynamics of this community and the opportunities it offers can help you on your journey to success on the platform.

More than 60% of sales on Amazon stores come from independent sellers.

Nearly 25 years after Amazon opened its platform to third-party merchants, independent sellers now generate more than 60% of all Amazon sales. In 2024, US-based independent sellers averaged over $290,000 in annual sales, with 55,000+ sellers surpassing the $1 million mark.

The economic impact extends beyond the platform itself. These sellers employed over 2 million people across the US in 2024, while collectively generating more than $2.5 trillion in Amazon sales over the past quarter-century.

Amazon independent sellers created 2 million U.S.-based jobs last year.

The impressive sales growth for independent sellers has led to the creation of an estimated 2 million U.S.-based jobs by small to medium-sized businesses. With Amazon independent sellers present in all 50 states, growth on the platform is expected to fuel more opportunities for economic growth in local communities.

Amazon independent sellers continue to grow in numbers.

The economic impact of Amazon’s seller community spans the nation, with independent sellers creating the most jobs in California, New York, Texas, Florida, and Georgia. These top five states are followed closely by Illinois, Pennsylvania, Washington, New Jersey, and North Carolina, rounding out the ten regions where independent Amazon sellers have the strongest employment footprint. This distribution highlights both established seller hubs and emerging markets for entrepreneurial growth on the platform.

Private-label brands are gaining traction.

Creating your brand and private label products can help you stand out and build customer loyalty. In 2023, this trend is likely to keep gaining traction. According to a consumer behavior report, 76% of Amazon shoppers are more likely to purchase a private label over a brand name. The main drivers for this purchase decision are lower prices, low shipping costs, and positive product reviews. If you’re considering private labeling, focus on these key factors to attract more customers.

Strategies for continued growth

The numbers above tell a remarkable story, but sustaining this level of success requires unwavering innovation. Amazon’s commitment to continuous improvement goes beyond mere statistics. It’s about forging partnerships with platforms and companies to deliver value-driven solutions that enrich the experiences of all users, whether they’re selling or buying on the platform.

Amazon’s partnership with Pinterest is expected to increase the online visibility of sellers.

Amazon has become Pinterest’s first partner for third-party ads. This alliance opens new horizons for sellers, increasing their online visibility manifold. With this partnership, Amazon can now display ads for Amazon products on the Pinterest platform. With more than 463 million monthly visitors looking for inspiration on Pinterest, Amazon sellers stand to gain more exposure for the products they’re selling. If you sell products related to home, fashion, food, and beauty, this development is great news for you.

Amazon simplifies listing creation using generative AI.

Amazon sellers can now leverage the new AI capabilities of Amazon to create better product listings. With this latest advancement, you can generate attention-grabbing titles, compelling descriptions, and more comprehensive product detail lists with less effort. The AI model can create them based on your product specifications and images. You can then use AI-generated content as is or refine it to your liking. The new AI tools available for all sellers are bound to enhance both the seller and buyer experiences on the platform.

Amazon empowers sellers with advanced tools that help accelerate business growth.

At the recently held Accelerate 2023, Amazon announced new third-party integrations and enterprise solutions that can help independent sellers manage and grow their Amazon shops. The new apps available for sellers include an AI-powered omnichannel marketing software, an inventory app with powerful integration capabilities, and enhancements to the Customer Sentiment Insights tool. If you’re a small business owner or new seller with limited resources, taking advantage of these Amazon tools can boost your growth.

Why staying updated is crucial for Amazon sellers

The Amazon marketplace moves at lightning speed. Yesterday’s winning product can become today’s dud overnight, and sellers who don’t track the right metrics often find themselves wondering what went wrong.

The data tells a clear story: successful Amazon sellers obsessively monitor trends beyond their own dashboards. Here’s why tracking these broader marketplace statistics matters:

- Customer habits change faster than ever. The products people search for, how they filter results, and what convinces them to buy evolve constantly. Without monitoring these shifts, your listings quickly become invisible.

- Amazon rolls out new features silently. The platform regularly launches tools that can dramatically improve visibility—but they don’t send you a personal invitation. Sellers who spot these opportunities first gain significant advantages.

- Data-backed decisions beat guesswork every time. When you know exactly which categories are growing and which advertising methods deliver the best ROI, you can allocate your limited resources where they’ll generate the most profit.

- Competition increases daily. With over 2 million active sellers, standing out requires spotting gaps in the market before others do. Statistical analysis reveals these opportunities while most sellers are still copying each other.

The most profitable Amazon sellers treat these statistics like a business dashboard, not interesting trivia. They use them to spot emerging opportunities, avoid declining categories, and make decisions based on what’s actually happening instead of what worked last year.

Ready to put these statistics to work for your business? Seller 365 combines 10 Amazon selling apps in one subscription. From intelligent product sourcing to automated repricing, inventory management to profit analytics—everything you need costs just $69/month instead of the $300+ you’d spend on separate subscriptions.

Try Seller 365 free for up to 14 days and see how the right toolkit helps you join top-performing Amazon sellers.