- Blog

-

For Sellers

Selling on Amazon vs. Walmart: Which is better in 2025?

Amazon dominates, but Walmart is catching up. See how the two stack up across costs, logistics, and seller perks in 2025.

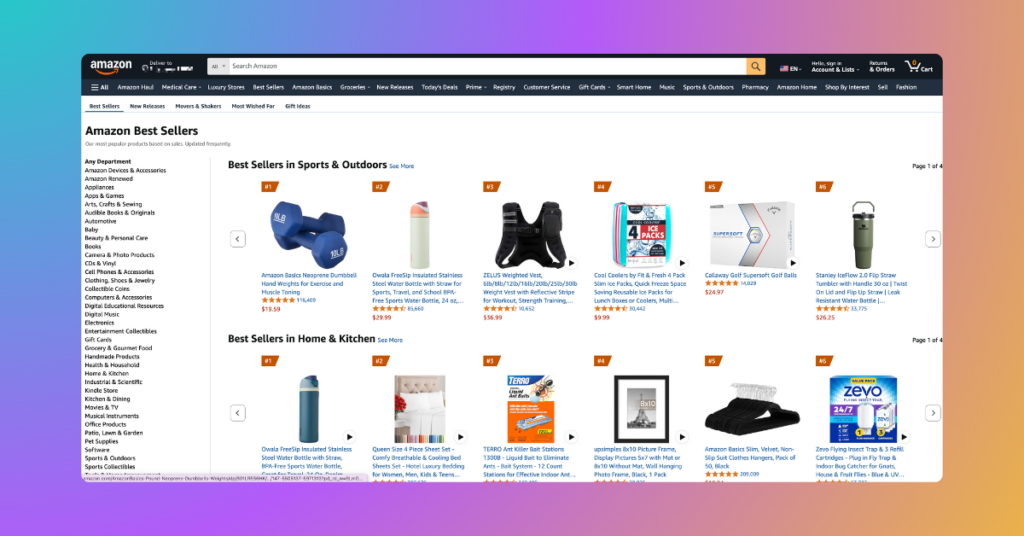

Amazon commands 38% of the US ecommerce market while Walmart holds just 6.4%. Yet Walmart’s marketplace is growing rapidly, attracting sellers with its zero monthly fees and less competitive landscape. So, which platform deserves your attention in 2025?

This comparison breaks down what matters most: fees, fulfillment options, customer demographics, and performance requirements. You’ll walk away with a clear framework to decide which marketplace aligns with your business model, products, and growth stage.

Overview of Amazon vs. Walmart in 2025

What is Amazon?

Amazon dominates ecommerce with $638 billion in overall sales and a market capitalization of $2.29 trillion. The platform hosts over a million US sellers who ship 4.1 billion items worldwide annually.

Third-party sellers account for over 60% of Amazon’s unit sales. The company’s Prime membership program boasts 200+ million subscribers across the world, creating a massive built-in audience for sellers.

Amazon’s fulfillment network spans 175+ centers globally, handling shipping and customer service for FBA sellers. Their AWS cloud segment generated $28.8 billion in revenue in 2024, driving nearly half of Amazon’s operating profits.

What is Walmart?

Walmart is the world’s largest retailer by revenue, generating $648 billion globally in 2024. Its ecommerce marketplace is growing rapidly, although it currently holds just 6.4% of US online sales.

The company maintains 10,616 retail locations across 24 countries, serving 255 million weekly customers both in-store and online. Walmart’s omnichannel approach integrates physical stores with digital operations, offering advantages in grocery, curbside pickup, and same-day delivery.

Walmart Marketplace has also since opened to international sellers and now hosts over 150,000 third-party merchants. The platform is investing heavily in its Walmart Fulfillment Services (WFS) program and Walmart Connect advertising platform, which generated $3.4 billion in 2023.

At-a-glance comparison

| Feature | Amazon | Walmart |

| Founded | 1994 (Jeff Bezos) | 1962 (Sam Walton) |

| Revenue (2024) | $638 billion | $648 billion |

| Ecommerce market share (US) | ~38% | 6.4% |

| Physical presence | Amazon Go and Amazon Fresh in some US states, but mostly online-first | 10,616 stores across 24 countries |

| Membership program | Amazon Prime (200M+ members) | Walmart+ (growing rapidly) |

| Global reach | Sells in 100+ countries | Operations in 24 countries |

Platform requirements & barriers to entry

Side-by-side eligibility comparison (in the US)

| Requirement | Amazon | Walmart |

| Business entity | Individual or business | US registered business entity (LLC, Corp) |

| US tax ID | Required | Required |

| Payment/billing methods | Any bank accepting ACH | ACH payments and credit cards |

| Monthly fees | $0 but 0.99 per item sold (Individual), $39.99/month (Professional) | $0/month (but with referral fees per item sold) |

| Marketplace access | Global (20+ countries) | US, Canada, Mexico, Chile |

Amazon allows virtually anyone to become a seller. You can register as an individual with just a government ID, tax information, and a credit card. Their Individual plan carries no monthly fee but charges $0.99 per sale, while the Professional plan costs $39.99 monthly with access to advanced tools.

Walmart maintains stricter entry requirements. Sellers must have a US-registered business, a US tax ID, and a US bank account. Though Walmart charges no monthly subscription fee, the platform’s manual review process and stricter verification create a higher barrier to entry.

Recommendation:

Amazon works best for:

- SMBs or DTC brands ready to scale with logistics and advertising support

- Manufacturers with established supply chains looking for a broad reach

- Creators and niche brands seeking access to 300M+ customers

Walmart is ideal for:

- US-based businesses with clean compliance history

- Sellers looking to avoid monthly fees

- Brands already successful on Amazon seeking to diversify

Consider alternatives if your margins are too thin to absorb fees, your products are highly seasonal, or personalized packaging is central to your brand experience.

Cost structure comparison

Monthly fees (as of June 2025)

Amazon’s Individual plan ($0/month + $0.99 per sale) suits low-volume sellers, while the Professional plan ($39.99/month) provides access to bulk tools, API integrations, advanced analytics, and advertising capabilities.

Walmart charges no monthly subscription fees for any seller, regardless of size or sales volume. This zero-fee approach makes Walmart appealing for testing new products or expanding from Amazon.

Referral fees by category

Amazon charges referral fees as a percentage of the total sale price (including shipping):

- Most categories: 8-15%

- Jewelry and watches: 20% above $250

- Media (books, DVDs): 15%

- Apparel: 5-17%

Walmart’s referral fees vary by category and price point:

- Apparel & accessories: 5-15%

- Beauty, health, and personal care: 8-15%

- Electronics accessories: 15% up to $100, then 8%

- Jewelry: 20% up to $250, then 5%

- Indoor & outdoor furniture: 15% up to $200, then 10%

- Books, media, toys, tools: Flat 15%

Walmart’s tiered structure often results in lower referral fees for higher-priced items, while Amazon tends to maintain consistent percentages regardless of price.

Fulfillment costs (FBA vs. WFS)

Both FBA and WFS include picking, packing, shipping, customer service, and returns processing. Amazon offers more granular sizing tiers, while Walmart focuses primarily on weight and dimensions.

Storage costs

Amazon FBA charges up to $0.87/cubic foot from January to September and up to $2.40/cubic foot from October to December (holiday season). Additional fees apply to inventory stored beyond 181 days.

Walmart WFS charges slightly less: $0.75/cubic foot from January to September and $2.25/cubic foot from October to December. Their aged inventory fees kick in later, applying only after 365+ days of storage.

So, here’s a sample breakdown:

| Item | Amazon (Pro + FBA) | Walmart (WFS) |

| $15 Phone case | $2.25 (referral) + $3.15 (FBA) = $5.40 | $2.25 (referral) + $3.45 = $5.70 |

| $55 Weighted blanket | $8.25 (referral) + $5.77 (FBA) = $14.02 | $8.25 (referral) + $5.45 = $13.70 |

These examples don’t include the $39.99 monthly Professional seller fee for Amazon, which adds overhead for lower-volume sellers.

Recommendation:

Walmart wins on monthly costs with no subscription fee, making it attractive for sellers with inconsistent sales volume. Amazon offers better FBA rates for very small and light items, while WFS may be more economical for seasonal or large-ticket items due to lower storage fees and longer aged inventory windows.

For sellers with margins under 25%, model all costs carefully before choosing a fulfillment method. FBA typically works best for small, lightweight items with high turnover, while FBM (or WFS) may better suit bulky or slow-moving goods.

Fulfillment options

Amazon FBA leverages 175+ fulfillment centers worldwide, offering Prime badge eligibility, access to Buy with Prime, and Multi-Channel Fulfillment (MCF). Fulfillment costs run approximately 70% lower per unit than comparable premium shipping services.

Walmart WFS promises 2-day delivery badges, increasing listing visibility and conversion rates. While more limited in scope (US-only), WFS often offers more favorable storage terms for seasonal inventory.

Self-fulfillment requirements

Amazon FBM sellers must use trackable shipping methods, meet Amazon’s shipping performance standards, and handle returns within policy timeframes.

Walmart self-fulfillment sellers must maintain strict on-time delivery rates and can use Ship with Walmart (SWW) for discounted rates through preferred carriers. Walmart enforces rigorous packaging, shipping label, and return policy compliance.

Shipping speed expectations

Amazon FBA delivers 1-2 day Prime shipping on 90%+ of US orders, including weekend and holiday delivery in key markets. FBM sellers set their own delivery windows but must hit 2-day timeframes for certain Buy Box eligibility.

Walmart prioritizes faster shipping in Buy Box decisions, with 1, 2, and 3-day delivery options receiving better visibility. WFS guarantees 2-day badge eligibility, enhancing listing appeal.

Recommendation:

Choose Amazon FBA if you need scalability, fast shipping badges, or international buyer access. The system works particularly well for sellers lacking warehousing experience or fulfillment infrastructure.

Consider Walmart WFS if you sell mid-sized goods with predictable volumes and want badge visibility without monthly fees. WFS generally offers more favorable terms for seasonal items with its longer aged inventory window.

Many sellers adopt a hybrid approach, using both platforms to reduce reliance on a single marketplace and optimize inventory placement based on product characteristics. Especially now that Walmart already allows Amazon MCF for shipping.

Customer base & shopping behavior

Amazon serves 300M+ active customer accounts worldwide, including 200M+ Prime members. The platform attracts a diverse audience but skews toward ages 25-44 and tech-savvy shoppers.

Walmart historically targeted lower-to-middle-income shoppers, but this is changing rapidly. As of late 2024, more than 50% of new Walmart+ members come from higher-income households ($100K+). The platform maintains a strong appeal among price-conscious rural and family households, though.

Purchase patterns

Amazon Prime members demonstrate high frequency and loyalty, averaging 25-35 orders per year. Shoppers rely on Amazon for everyday essentials, gift purchases, and subscription items through Subscribe & Save. Cross-category purchasing (adding multiple product types to a single cart) is common.

Walmart excels in grocery, household essentials, baby products, and personal care categories. The platform sees strong performance during back-to-school periods, holiday seasons, and local promotions. Walmart.com shoppers exhibit one-stop shopping behavior and frequent repurchasing of consumables.

Price sensitivity

Amazon customers are value-driven, expecting competitive pricing, bundles, promotions, and Prime-exclusive deals. The Amazon algorithm favors the lowest total price (including shipping) in Buy Box placement.

Walmart maintains a price-first brand identity, with value messaging as a key driver. Their Everyday Low Price (EDLP) strategy extends to online pricing algorithms. Marketplace sellers must remain price-competitive to maintain Buy Box visibility.

Product discovery behaviors

Over 60% of US consumers start product searches on Amazon rather than Google. Discovery happens through Amazon search (SEO-optimized listings), Amazon Ads (Sponsored Products, Brands, Display), reviews/ratings, and shoppable content like 3D models and AR features.

Walmart customers discover products primarily through site search, homepage merchandising, and category ranking. Walmart Connect ads (Sponsored Products, Display) influence visibility, as do store-level stock integrations and ship-to-store capabilities. The platform features fewer brand-first discovery journeys, with value and relevance taking priority.

Recommendation:

Amazon performs best with tech accessories, private-label skincare, supplements, home goods, and baby products. Products with recurring purchase intent often thrive. Challenging categories include commoditized, low-margin items and products requiring personal consultation.

Walmart excels with groceries, personal care, pet supplies, toys, home goods, and automotive products. The platform favors branded or private-label items priced in the mid-to-low range. Luxury goods, niche electronics, and DTC products requiring extensive storytelling typically struggle.

Seller tools & support

Amazon provides a comprehensive ecosystem for listing management, inventory syncing, and fulfillment. Features like Brand Registry, A+ Content, Amazon Vine, and Buy with Prime help build brand equity and drive conversions.

Walmart Seller Center offers bulk listing tools, item setup templates, and inventory feed integrations. While more limited than Amazon’s offering, the platform provides promotions management for coupons, rollbacks, and flash deals. Third-party integrations like CedCommerce extend functionality.

In terms of analytics capabilities, Amazon’s Seller Central includes Brand Analytics (search term reports, repeat customer data), Growth Opportunities (data-driven recommendations), Product Opportunity Explorer (emerging trends), and Manage Your Experiments (A/B testing). The Selling Partner Appstore enables integration with third-party tools as well.

Walmart provides real-time order tracking, an Item Performance Dashboard (sales, impressions, click-through rate), Buy Box reporting, and pricing optimization recommendations. Walmart Connect offers ad performance metrics, while API integrations enable deeper data analysis.

Recommendation:

Amazon works best for sellers needing rich data, advanced advertising tools, and fulfillment automation. The platform enables brands to test, optimize, and scale efficiently, though support quality can be inconsistent.

Walmart suits sellers comfortable with self-service tools and basic feed management. The platform may challenge high-SKU sellers requiring full-service onboarding or teams lacking strong in-house operations expertise.

Performance requirements

Amazon uses the Account Health Rating (AHR), scored from 0-1,000:

- Green (Healthy): 200-1,000

- Yellow (At Risk): 100-199

- Red (Unhealthy): 0-99

Amazon’s performance metrics include:

- Order Defect Rate: <1%

- Late Shipment Rate (FBM): <4%

- Cancellation Rate: <2.5%

- Valid Tracking Rate (FBM): >95%

Meanwhile, Walmart’s performance metrics include:

- On-time delivery rate: >95%

- Cancellation rate: >95%

- Valid tracking rate: >99%

- Refund rate: <6%

- Seller response rate: >95%

Amazon AHR drops trigger warnings or account suspensions. Critical or repeated violations may cause immediate deactivation, particularly for inauthentic item claims, shipping delays, IP complaints, or product safety issues.

Walmart non-compliance can lead to Buy Box suppression, temporary listing suspensions, or account deactivation in severe cases. Performance dashboards alert sellers to compliance risks before penalties apply.

Recommendation:

Amazon demands operational precision, favoring businesses with reliable logistics, inventory management, and customer service processes. The platform presents risks for sellers lacking visibility into shipping, returns, or customer complaints.

Walmart similarly rewards sellers who maintain tight shipping SLAs and reliable inventory management. Sellers using manual order handling or unoptimized warehouses may struggle to meet performance thresholds consistently.

International selling considerations

Amazon Global Selling enables access to 20+ marketplaces worldwide, including the US, UK, Germany, Japan, UAE, Australia, and India. The platform provides localized infrastructure for payments, fulfillment, and customer service through FBA Export and MCF.

Walmart Marketplace officially serves US-based sellers only as of 2025. While Walmart operates in 24 countries, marketplaces remain regionalized (Walmart Canada, Walmart Mexico) without a unified global selling model.

Recommendation:

Amazon suits brands with international ambitions and scalable logistics, especially those with existing export experience or global trademarks. The platform’s unified selling approach simplifies multi-country expansion.

Walmart works best for US sellers focused on domestic growth or brands with established warehousing in Canada or Mexico. The platform isn’t suitable for global-first sellers seeking broad international reach.

Amazon vs. Walmart: The verdict

The choice between Amazon and Walmart depends on your business model, product type, and growth stage. This decision matrix highlights which platform better suits specific seller scenarios:

| Business type | Best platform | Why |

| DTC brand with US trademark | Amazon | Access to Brand Registry, A+ Content, global reach, Sponsored Brands/Display |

| US manufacturer (non-DTC) | Walmart | Lower entry costs, access to value-conscious US shoppers, strong in essentials |

| International seller (non-US) | Amazon | Accepts global sellers with cross-border tools; Walmart requires a US entity |

| Small startup (<$10K inventory) | Tie | Amazon if using FBA + fast scaling; Walmart if operating lean with no subscription fees |

| High-margin product seller | Amazon | Can absorb higher fulfillment and ad fees; better content and brand controls |

| Low-margin, high-volume seller | Walmart | No monthly fees; longer aged inventory window; value-seeking audience |

| Digital-first DTC with brand storytelling | Amazon | Richer content tools, brand-building features, and social integrations |

| Logistics-constrained seller | Walmart (WFS) | Fewer SKUs with efficient fulfillment; lower fee burden |

| Enterprise multi-channel seller | Both (hybrid) | Use Amazon for scale/global reach; Walmart for US market diversification |

Many established sellers now adopt a hybrid approach, using both platforms to reduce dependence on a single marketplace. This strategy helps mitigate policy changes, fee increases, and algorithmic updates that might impact visibility.

In essence, though, if you’re new to ecommerce, Amazon offers an easier entry point with more seller resources and tools. For businesses looking to expand, Walmart presents an opportunity to reach value-conscious shoppers with less competition.

Whichever platform you choose, consider using Seller 365 to streamline operations. Seller 365’s suite includes FeedbackWhiz Alerts and Profits, which work with both Amazon and Walmart, helping you monitor performance and track profitability across marketplaces from a single dashboard. On top of those two, it also has 8 more apps you can use to fast-track your selling journey, all for just $69/month.

Ready to optimize your marketplace selling strategy? Try Seller 365 free for up to 14 days and experience how an integrated toolkit can transform your Amazon and Walmart operations.